GALVESTON – The Galveston City Council voted Friday to adopt a property tax rate of $0.408687 per $100 of taxable property valuation for the 2025 tax year.

The adopted rate includes $0.039755 for debt service and $0.368932 for maintenance and operations, which incorporates $0.05 per $100 of taxable property value dedicated to the Rosenberg Library.

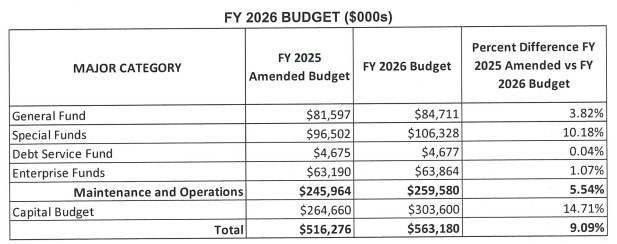

The FY 2026 Adopted Budget and Capital Improvement Plan (CIP) continues the city’s commitment to fiscal responsibility, infrastructure investment, and alignment with council priorities. The budget accounts for increased costs related to EMS service provision, a 10% rise in health insurance costs, and separation pay associated with retirements. Police and Fire Department salaries also reflect contractual increases.

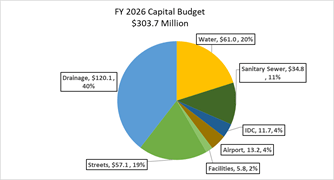

Major infrastructure investments outlined in the proposed CIP include:

- $61 million for water system improvements

- $35 million for sewer upgrades

- $57 million for street improvements

- $120 million for drainage projects

These projects will be funded through a combination of city bonds, federal grants, and local contributions.

The FY 2026 budget also addresses hotel occupancy tax (HOT) funds, Convention Center obligations, and annual general obligation debt payments while maintaining a focus on service continuity and long-term infrastructure resilience.

All budget documents are available online at galvestontx.gov/financialtransparency.

Photo courtesy: City of Galveston

You must be logged in to post a comment.